2023 Berkshire Trip

Compounding Goodwill & Dinner with Teqnion

My friend J invited me to the Berkshire Annual Meeting this year and I’m glad he did, what a positive trip. Every year the annual meeting draws like-minded individuals and investors from across the globe to Omaha for a week in May. It was our first year attending and we drove through 10 hours of prairie-land to Omaha which gave us a lot of time to chat and catch-up.

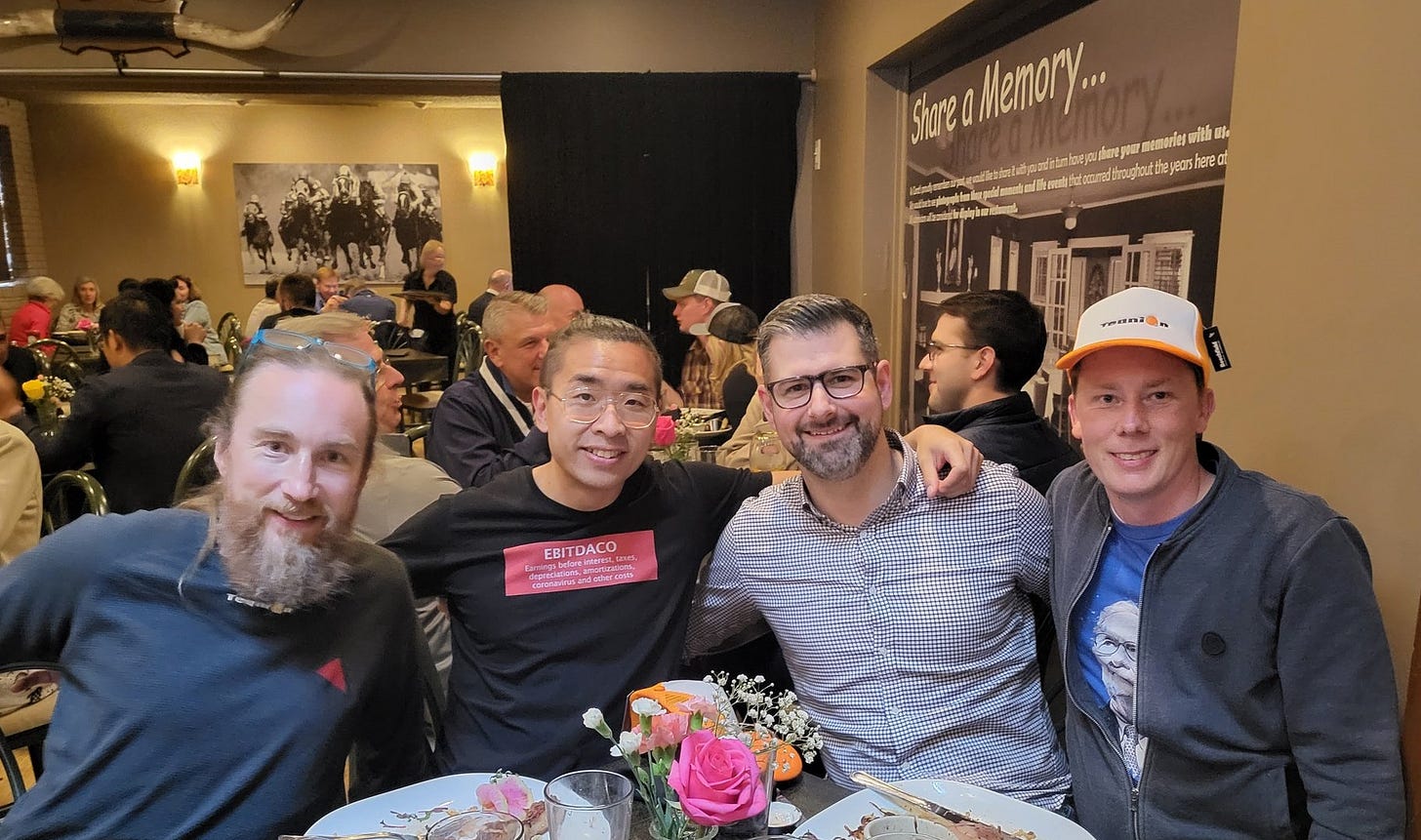

We were in Omaha for two days - on the first day we attended Guy Spier’s VALUEx BRK event and had dinner with Johan and Daniel from Teqnion (founder and ‘CXO’ respectively) and on the second day we attended the Berkshire annual meeting at the CHI Health Center Omaha.

VALUEx BRK and Compounding Goodwill

Guy Spier’s VALUEx event (think TEDx for investing) was free to attend and the speakers included Mohnish Pabrai, William Green, Syed Balkhi, Adam Mead, Bryan Lawrence, Christian Billinger, and Cathy Baron-Tamraz, among others. I’m not sure how many people were in attendance but it looked like over 200.

Big thanks to Guy for hosting this event for free, he didn’t even advertise his fund anywhere following his own rule which discourages solicitation.

Why would he put on a free event and provide lunch for 200+ people in a nice hotel? He noted it was in “the spirit of Omaha,” but it also aligns with what he wrote in ‘The Education of a Value Investor’, about an approach which was echoed several times on the trip: the power of compounding goodwill.

Most have heard of the power of compounding wealth, which is the process of reinvesting an asset’s earnings to generate additional earnings over time.

A lot have heard about the power of compounding knowledge, where information becomes more valuable and easier to comprehend when you have existing information to connect it to. For example, you will absorb more knowledge from a book on finance if you’ve already read ten books on the topic versus if you have only read one.

Compounding goodwill shows us that being a “giver” rather than a “taker” will lead to unexpected benefits and create tremendous long-term value in investing, business, and life. Guy details the process in his book more eloquently than I ever could:

The Education of a Value Investor - Chapter 12: Doing Business the Buffet-Pabrai Way

Over the past ten years, I’ve repeatedly observed how [Mohnish Pabrai] looks to see what he can do for others, not the other way around ... I saw how he would focus first on creating a real relationship and would then constantly look for ways to give, not take. He wasn’t pushy. He didn’t put people under any obligation. He seemed simply to ask himself, “What can I do for them?” Sometimes this was a kind word or a piece of advice; sometimes it was an introduction to someone else; sometimes it was a book that he would send as a gift and as a way of saying that he was thinking of that person.

By acting in this way, I could see that Mohnish created an incredible network of people who wish him well and would love to find ways to help him and thank him for his kindness. This is the extraordinarily powerful effect of compounding goodwill by being a giver, not a taker … the paradox is that you end up receiving infinitely more in life by giving than by taking. There’s a real irony here: in focusing on helping others, you end up helping yourself too. For some people, this is not easy to understand. They act instead as if life were a zero sum game, in which the person who gives something away is the poorer for it.

Buffett, of course, understands this perfectly … he told a class at Georgia Tech “when you get to my age, you’ll really measure your success in life by how many of the people you want to have love you, actually love you. I know people who have a lot of money, and they get testimonial dinners and they get hospital wings named after them. But the truth is that nobody in the world loves them. If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is, your life is a disaster. That’s the ultimate test of how you have lived your life.”

It is helpful with any type of compounding to start as soon as you can.

Dinner with Teqnion

After the VALUEx event we headed over to Warren Buffet’s favourite steakhouse, Gorat’s, to meet with Johan and Daniel from Teqnion.

Teqnion is a company which currently could be viewed as having a pricy valuation (PE of 32.5). I originally found the company through Chris Meyer’s twitter (writer of 100 baggers) and I may write a post on the company later, but meanwhile here is a good interview which summarizes their business:

YouTube: Teqnion Stock Explained w/ Daniel Zhang

The food at Gorat’s was good and Johan and Daniel were great company. They have been quite successful running Teqnion and they came across as knowledgeable with a reverent view of their shareholders. Johan is an avid runner and Daniel has quite a few interests, including investing, gaming, and running.

Berkshire Annual Meeting

The actual meeting was ok; our seats were quite far away since it was first-come first-served and we didn’t arrive until a couple hours before the gates opened.

This was a portion of the line that had built up by the time we got there:

This is the view from our seats:

Considering our seats, the annual meeting would have been more comfortable to watch streaming from home, but we enjoyed the scale of the event and were able to pick up some See’s candy and Berkshire shirts from the vendor hall.

One takeaway I had was that AI will likely be a big thing, but it will be difficult to tell early on which companies will be the winners.

At the 2021 annual meeting, Warren Buffett cautioned investors about the difficulty in identifying winners in new and growing industries. He pointed to the large number of companies that made automobiles in the early 1900s, most of which closed down or got out of the car business well before the industry had matured: “There’s a lot more to stock picking than just figuring out what is going to be a wonderful industry in the future.”

Insightful piece. I would encourage you to post on Teqnion whenever you have time. The part on compounding goodwill is such an important concept, to me it highlights the principle of transcendence. It is a mystery that is hard to explain but everyone that tries sees the results. Thank you Curious Investor