AI Supercycle: 10 Companies I Like Heading Into 2026

Including a mock portfolio and the reasoning behind each pick.

In this post I am going to give a brief overview of my current thoughts on Artificial Intelligence (AI) and where we are in the cycle. I will also provide a mock portfolio of 10 companies I like heading into 2026, along with my reasoning for selecting each company (so that we can look back and see how right or wrong I was).

The core idea: AI will drive a major capex cycle and significantly augment services performed by humans today, boosting real-world output. As investors, we should be thinking about which companies will capture the economics of this cycle.

Let’s start with an anecdote: before spreadsheet software came out (around 1980), it would have taken 5 accountants to do the work that 1 proficient Excel user can today.

Using the internet → being able to search for already solved problems, or interpretations of tax guidelines (instead of reading through Tax Acts) - probably doubled the efficiency / output of the average Excel finance worker.

Now AI, as a tool, has perhaps doubled efficiency again → now accountants can code and near-instantly solve problems that used to take a lot longer.

“So software (5X output) is 2.5 times as revolutionary as AI (2X output)?”

That is linear thinking. Consider this instead:

1 person * 5X software = output of 5 people.

5 people * 2X internet = output of 10 people (5 incremental).

10 people * 2X AI = output of 20 people (10 incremental)

So one accountant can do the work that 20 people used to do, as recently as 1980. We are talking exponential increases in efficiency / output.

<The numbers above are rough and (hopefully) directionally correct — I tried not to be too optimistic or too conservative>

Productivity has increased quickly over the last century and peoples’ lives are better in a lot of ways: less worldwide poverty, better health outcomes (before the 1940s an infection was likely to kill you), and we all have a device in our pocket with infinite entertainment. The bottom two rungs of Maslow’s Hierarchy are not a concern for most in the developed world.

“But housing is more expensive.” Yes, not everything is solved. Houses are also a lot nicer (and bigger) these days, with nice HVAC systems and amenities that weren’t common or didn’t exist when houses were cheaper.

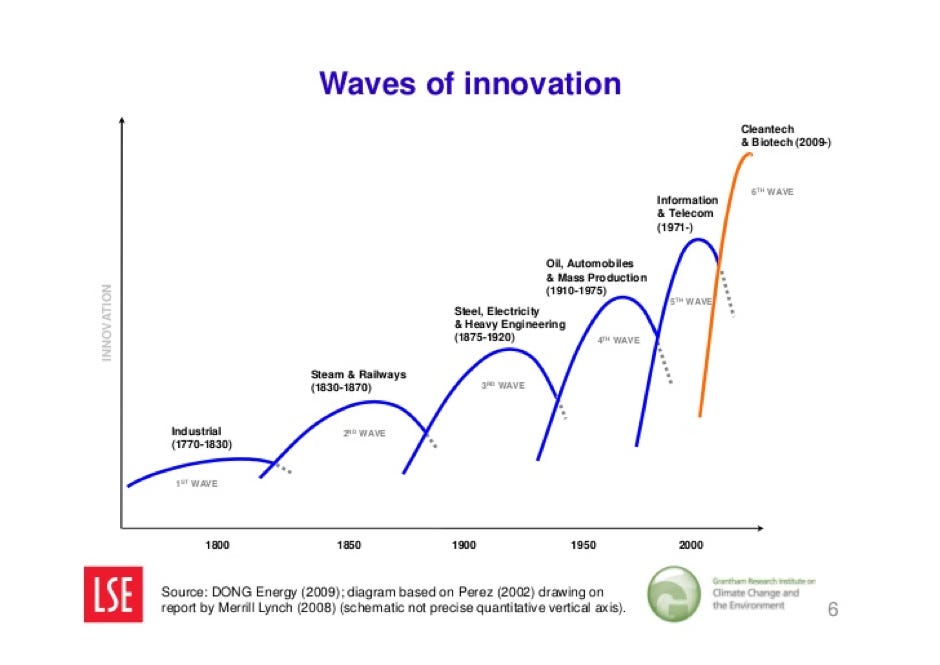

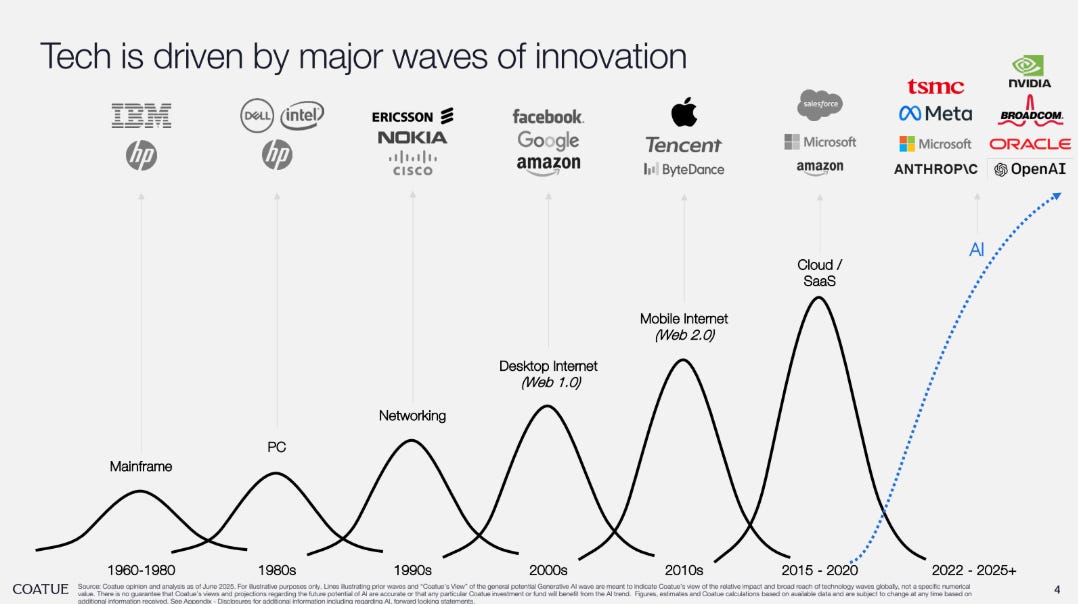

This progress is thanks to technological innovation cycles from the industrial revolution and onwards, all the way to our current AI innovation cycle.

If you were to invest in any of these innovation super-cycles, and you picked the right companies, you would have been generously rewarded.

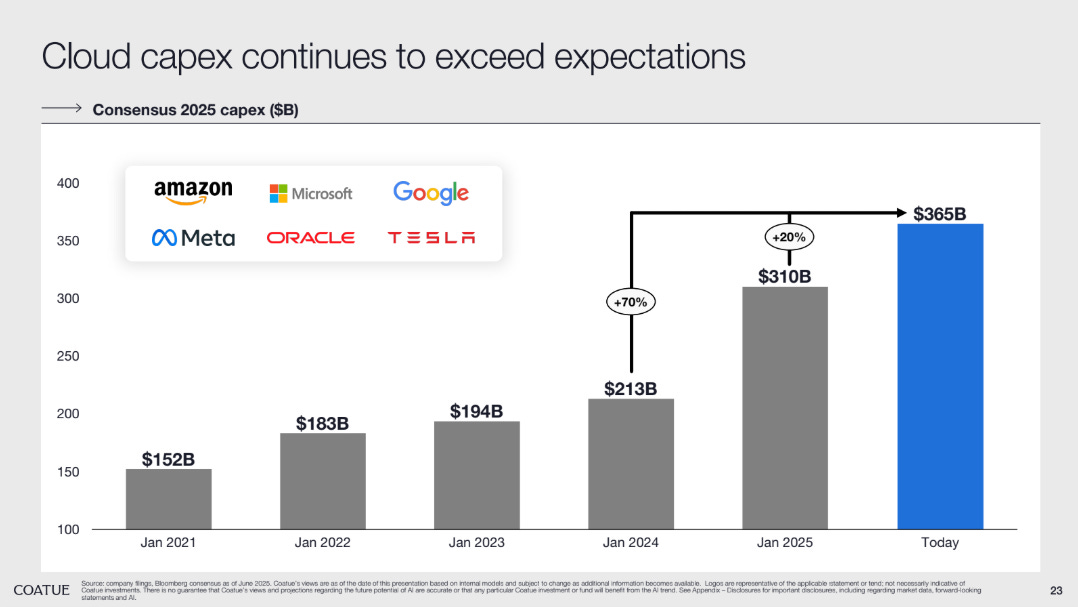

We are seeing increasing investment into AI. Even if everyone doesn’t hit their targets, the capital spend is so large (and fast) that it will be a boon for the economy and perhaps the stock market. This spend on trades-people, tech-people, and materials will do much more for the real world economy than when huge companies buy back their own stock with excess cash.

As investors, we should be thinking about (1) what companies will benefit from that spend, and (2) the magnitude of that spend compared to a company’s current market cap (and its theoretical profitability).

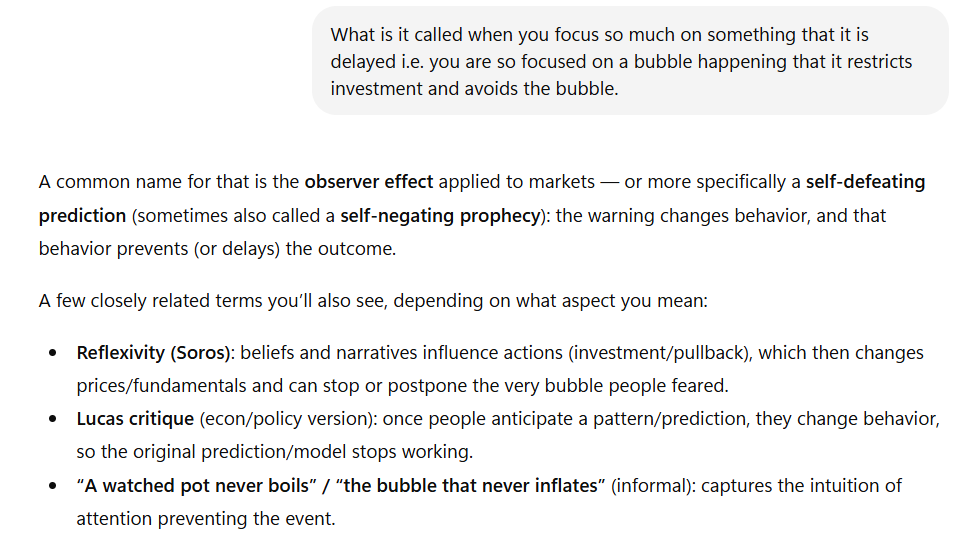

Market pundits are discussing a bubble in AI and are cautious about investing in the AI theme, expecting a crash similar to the 2000 dotcom/telecom bust (the NASDAQ fell by 75% from March 2000 to October 2002).

I am completely on the other side of the bet.

Yes capital will likely be overspent on the infrastructure eventually, but I don’t think we’re there yet. I also think it’s possible that since we are so focussed on the bubble it could push the “popping” of the bubble out further.

With that said, there are still companies I am avoiding: (1) anything pre-revenue (i.e. robotics); (2) pure hardware plays (especially cyclical), including semis; and (3) model companies (for the most part). I’m not saying these companies won’t do well over certain time periods, but I include them in the “too hard for me” pile.

On models, I am most uncertain about who will win out of the base LLM models or if they will end up being a commodity, and as a result, I have little invested there. I feel best about my investments in a selection of software companies that will sell tokens and collect some of the economics on the pass-through of compute (I’ve included some examples below). They are the platforms/distributors of the LLMs, they don’t incur the significant costs of training the models, and they can markup the cost of inference for the end user (as toll collectors).

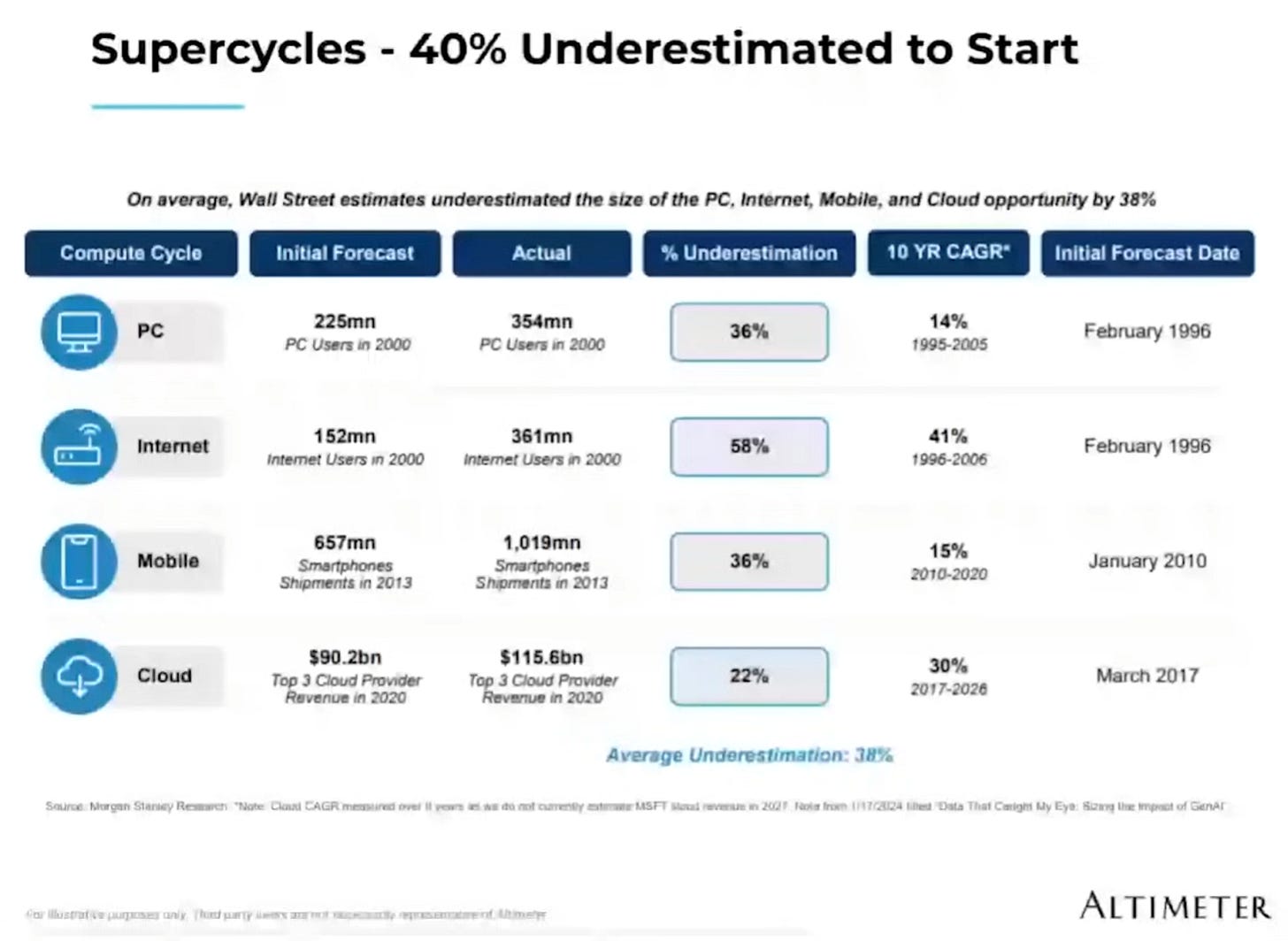

We often underestimate the size of super-cycles in hindsight. We knew the internet would be big, but the opportunity ended up being over twice as big as initially forecasted. AI will likely end up being a bigger opportunity than we originally anticipated.

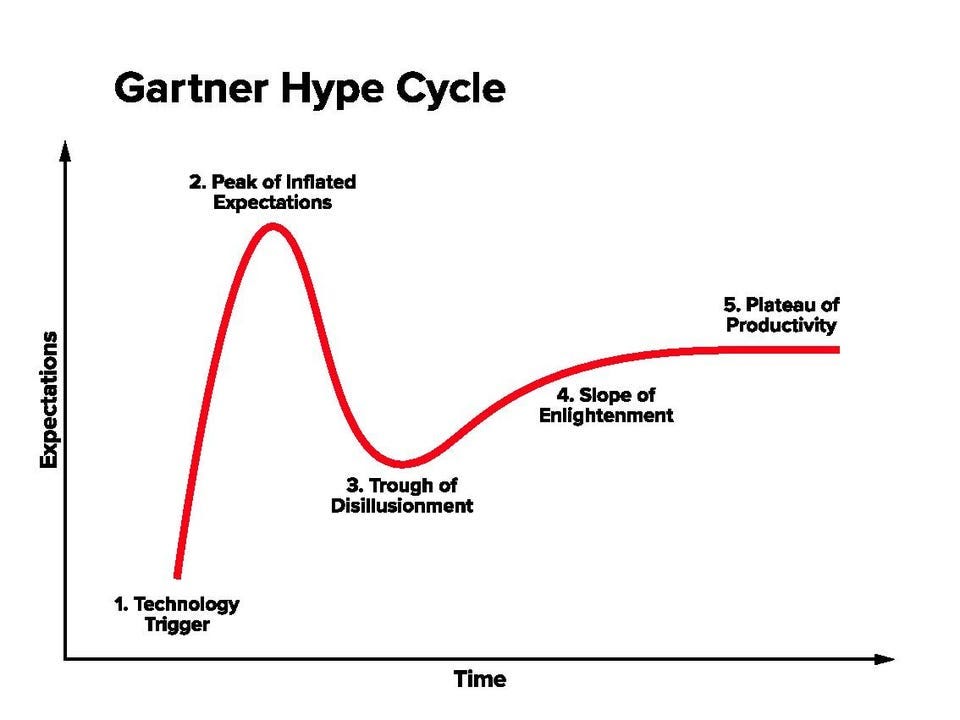

We also overestimate what new technologies can do in the short-term:

Market commentators are quick to hype new technologies, but we rarely see the benefits as quickly as they think. Human emotions overshoot to the upside then overshoot to the downside, all before realistic expectations set in. This could be why the narrative for AI stocks swung so quickly from a) over-exuberance leading up to the Summer of 2025 to b) the subsequent fall into the end of the year (“AI Bubble”).

We’re still far from seeing AI’s full potential, and it may take years to get there; life-changing technologies take time to gain widespread adoption.

To be clear, I think a bubble is still possible, and even likely in certain subsectors, but for the companies I mention below I think we are still early.

I find myself saying this a lot: “Today, AI is the worst it will ever be”

If models still make mistakes, will they ever be good enough?

Google and Anthropic’s latest models indicate that more compute and more training is leading to “smarter” and more accurate models. This could indicate we can still make the models better by throwing more compute at them.

I liked some of the comments from this recent podcast (BG2). Ali Ghodsi posits that we are already at AGI → we can create great products and unlock great productivity without even making the models better. I tend to agree, the current models are good enough to perform significant service work already (coding, customer service, marketing customization). Although they do require some human intervention, software, or guardrails to work optimally.

If that’s true, if the current models are already good enough, then will we need much more infrastructure ?

An emphatic YES:

as AI usage increases, so does inference compute; and

as long as more compute produces materially better models (scaling laws), it still makes sense to keep investing.

With that frame in mind, here’s how I’m playing the AI theme.

Mock AI Portfolio

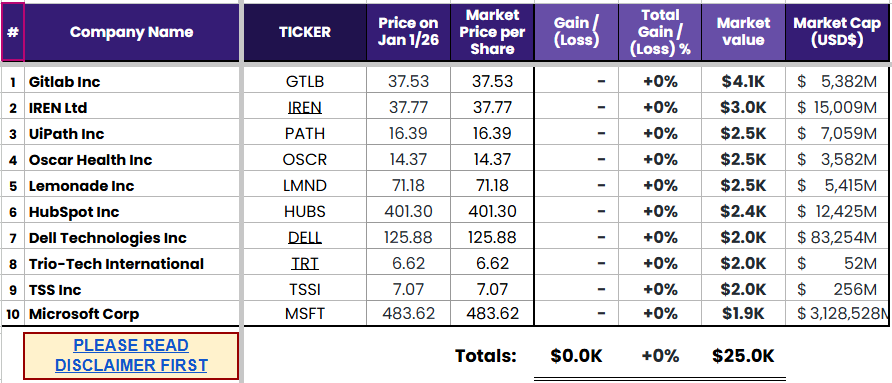

I put together a mock AI portfolio with some of my favorite AI picks. I own all of these companies today, but I could trim or sell out of them at any time and I won’t necessarily provide an update if I completely sell out of a name or trim.

The mock portfolio is based on a $25K starting point (not real money).

I don’t recommend anyone copy this portfolio → this is intended for education and entertainment. This is a concentrated portfolio with only 10 holdings, which increases risk. If you weight one theme too heavily in your portfolio it is susceptible to large draw-downs.

For reference, in my portfolio I typically hold between 20 and 30 different companies and put max 5% into an initial position (I will let positions grow larger than 5%, but they have to earn it). I also hold companies that I wouldn’t include in the AI theme.

I have historically focused on microcaps and small caps (in the blog and my personal holdings), but you’ll notice a few of these are larger companies. This strategy change is specific to what I perceive to be the “AI Super-cycle.” I will likely be back fishing in micro/small cap land once I perceive this opportunity has passed.

Portfolio link:

Google Sheets: RTW Mock AI Portfolio

or

https://docs.google.com/spreadsheets/d/1ocOx2WNXWgNFNY7Qod7SDmWzp3DwWmT7KSVA4ciDikE/edit?usp=drivesdk

Let’s see how the basket does over the next 3 years.

I friendly-bet (only my pride at stake) that it:

beats the S&P 500 Total Return, and

<bold prediction> returns 26% per year at peak value i.e. the portfolio hits $50K at some point before December 31, 2028 (starting from Jan 1, 2026).

These bets are particularly bold because I won’t be able to sell the names if my thoughts change or reallocate cash if one of them is acquired.

We can also compare how my predictions played out 3 years from now vs what I wrote today.

The below is my high level thoughts on each company. Please double-check facts and perform a fulsome due diligence yourself if any of the companies are of interest to you.

INFRASTRUCTURE

These are the companies supporting the construction of compute intensive data centers that will be used by model companies and compute marketplaces.

The biggest risk to these companies is if breakthroughs in compute efficiency outpace the increase in demand for compute; if so, it is possible less infrastructure would be required.

#1 - IREN Ltd

(I am up multiples on my original investments in IREN and it is my largest position even after significant trimming)

Iren is a bitcoin miner that has moved into the AI data center space. They are vertically integrated, have access to power, and own/operate data centers primarily in Texas and Prince George (Canada) for now. They also have the opportunity to offer co-location as well (where a company leases the land and power from IREN).

IREN has 2+ gigawatts (GW) of power access coming online between 2026 and 2027 (for scale, that is enough electricity to power 2 to 3 small to medium sized cities).

I think the infrastructure bubble calls are early → power is still a constraint for the AI build-out and if you are hearing a lot of data center project announcements, they’re usually for 2027+.

The co-founders (brothers Dan and Will Roberts) are capable capital allocators and are aligned (they receive significant stock awards for increases in share price).

Management is the primary reason for this investment. I’m not that bullish on the industry in general i.e. I will not be investing in companies like CRWV, nor other companies that have become popular because of their access to power (not saying they won’t do well).

Infrastructure investments have a heavy reliance on management, and their capital allocation skills. IREN’s management has built a $12B company and consistently hits their targets and deadlines.

Speculative on my part, but I think it’s possible we could see a co-location deal for their Sweetwater campus in the next 5 months, as building out 2 GW would require significant resources.

They secured a deal with MSFT on ~200 MW for ~$1.94B revenue per year. This comes with additional capital requirements which will increase enterprise value (not market cap/price).

The terms of this MSFT deal are hotly disputed (with respect to Return On Investment or IRR%). However, as a first deal it is the best partner I can think of (I might be biased → see my write-up on MSFT below). If IREN performs on this agreement (builds on-time and meets quality/uptime requirements) it will give them credibility in future deals.

I think it’s probable the terms of this deal may not be as good as future deals will be.

Management has heard investor feedback loud and clear and they will have even better perspective going into their next deal.

Even if compute for model training slows down (though I think it continues to grow for the next 2+ years), inference will still be required. Think about some of the services being replaced or augmented (coding, customer service, marketing, legal), every service provided by AI will require inference compute. There will also be more usage of services as the models become cheaper and better (Jevon’s paradox).

I’m not sure how long of a hold IREN will be for me, this is one I will be watching closely over the next few years as it’s difficult to interpret “what’s next” until we’re a few years out. This is not a long-term compounder type company, I am just trying to capture temporarily underappreciated value in the market.

Portfolio weighting factors: (Moderate to high downside / High upside)

#2 - TSS Inc

(I originally purchased TSSI between $0.90 and $2.50, sold out completely above $20 and now repurchased just under $9)

TSSI assembles the racks that go into data centers. They employ the technical trades people who assemble and ensure the racks are working together reliably.

Significant customer concentration risk (Dell). I’m starting with this because if they lose Dell as a customer (or if Dell exerts too much pressure on margins) the company could be worthless. This is also why it is a smaller weight in the portfolio.

I don’t think they will because (1) as laid out in the AI theme above, I think there will be consistent demand for years and (2) building reliable AI data centers (with evolving technological requirements) is a skill that is and will continue to be in high demand.

TSSI helped build the xAI data centers, which would have been invaluable experience for them. These are not standard data centers and requirements are evolving constantly (liquid vs air-cooled; power requirements per rack significantly increasing).

If general trades (electricians & construction workers) are in high demand in these areas, imagine the day-rates of a specialized data center assembler.

How do I know building these data centers require specialized knowledge? Because IREN is outsourcing the supply and delivery for the Microsoft deal to Dell ($5.8B deal including hardware).

Investors like to focus on revenue and they like predictability, but as I’ve said in previous posts, not all revenue is the same:

Integration revenues have consistently climbed and this is where the company is earning their income after all costs are considered (these are the revenues to focus on). They are expanding capacity as best as they can.

Procurement services will fluctuate wildly for TSSI, but they are so low margin that it doesn’t matter. It was inevitable that they would drop off at some point, and they’ll likely come back at some point (and drop off again after that, etc, etc).

I think this is a large driver of the recent drop in stock price.

Lottery ticket on the chance that the on-site modular data centers segment gains traction.

If the racks & chips only have a useful life of 5 years (bear thesis), then TSSI gets to redo all this work every 5 years in addition to new builds.

Did I mention significant customer concentration risk? I’ve been burned by this in the past (Payfare).

Portfolio weighting factors: Moderate to high downside / High upside

#3 - Dell Technologies Inc

The thesis for Dell is simple, I think we could see a multiple re-rate in addition to material revenue & earnings growth, driven in part by what I expect to be earnings beats over the next ~8 quarters. The increase in earnings will come from more, and higher margin, data center contracts (higher margin than their current business).

Dell is a massive company and it will take a lot of business to move their bottom line & margins, but AI is a big opportunity. Their net income margins hover slightly below 5% and revenue hasn’t grown significantly over the last 5 years.

The market has realized this and has priced it in somewhat → the stock price has increased ~3.8X over the last 5 years. My bet is that the market is still under-estimating how beneficial the AI theme will be for Dell.

One risk with Dell is that component price increases (high-bandwidth memory & GPU chips recently) will be a headwind as it takes time to pass incremental costs through to customers. So this thesis rests on the hope that the increase in data center earnings will outweigh this headwind. Regardless, this risk is why I’ve weighted the position lower.

Portfolio weighting factors: Low to moderate downside / moderate upside

TOKEN DISTRIBUTION (TOLL COLLECTORS)

Below are some software platforms that customers may use AI inference through. I think these companies could charge a fee on the pass-through tokens for little incremental cost to the platform.

These are my favorite investments of the bunch because:

If my thesis works out, they will see a step change in revenue and earnings growth that the market isn’t pricing in.

Software multiples have been depressed due to AI fears.

Their base software businesses could act as a floor even if the AI theme doesn’t fully pan out for them.

As always, I will be wrong on some of this stuff, and it could be these names.

#4 - Gitlab Inc

GitLab is an end-to-end DevSecOps platform that helps teams plan, build, secure, and deploy software from a single application (available as a cloud service or self-managed). Its core capabilities are source code storage and review, task planning, automated testing and deployments, and built-in security checks.

If we think there will be more coding because of AI (more people can code, experienced developers can code more/faster, and Jevon’s paradox), it seems logical that Gitlab usage would go up. Companies still need the infrastructure, security, and workflows for developers to manage their code base (even if the work is done by agents).

Gitlab is about to release their usage based coding assistant which could (1) entice people to upgrade to a more expensive package and (2) act as a tailwind to revenue and earnings growth through token markups (lower margins perhaps, but that’s ok).

Gitlab:

is no longer founder-led, but the co-founder (Sid Sijbrandij) is still involved (on the Board).

A new CEO was recently brought in as Sid stepped down to focus on his health. The new CEO, Bill Staples, has focused his efforts on revamping Gitlab’s go to market strategy, which is what he did in his previous role at New Relic.

Sid is still the largest block of voting shares, which is relevant because there have been rumours about a potential acquisition. I am hoping the company stays public at least until we see the effects of usage based AI.

is trading at ~7 Price to Sales (P/S), which isn’t bad for a company with 88% gross margins, low capital intensity, and 20%+ revenue growth (especially if growth inflects higher).

has predictable revenues; and,

has a massive relative TAM.

Gitlab is my favorite out of the 10 picks because the AI opportunity in code is significant and already here, but that doesn’t mean the investment will work out.

Portfolio weighting factors: Low to moderate downside / high upside

#5 - UiPath Inc

UIPath is a robotic-process-automation (RPA) company. In layman terms, they set up workflows that can be performed by a computer automatically (a workflow a human normally would have done). The problem with RPA is that it’s rigid in structure and doesn’t scale well → it needs a specific set of rules to follow and specific inputs because it doesn’t handle nuance well.

In a really simple example, they could take invoices that always look the same and input them into a database over and over. But if those invoices looked a lot different (had totals in different spots, different languages, different currencies, hand-written codes), it would be difficult to code all the possible exceptions into RPA.

This is where AI fits in nicely. AI is good at interpreting less rigid data.

Though, AI in its current form isn’t great at performing even repetitive tasks on its own, it needs instructions and guardrails for what to work on.

From Sherwin Wu (paraphrased): it feels counter-intuitive that AI physical autonomy is ahead of digital autonomy; for example, autonomous vehicles are closer to a solved problem than being able to book a ticket online seamlessly through an AI agent. One of the reasons is that autonomous driving has guardrails -> roads, traffic laws, rules, etc. Whereas AI agents are just dropped in the middle of nowhere, they don’t have the scaffolding (protocols) or infrastructure in place and are left trying to feel around what they should do.

I think that UIPath’s RPA could help solve this issue for digital autonomy. Their orchestration is the structure & protocol, or set of rules, that will allow AI agents to be useful. Without it, people will be consistently disappointed, at least in the near term, as they expect AI to do more than it can.

UI Path:

has aligned and competent management (founder-led);

has predictable revenues;

is the leading company in RPA

has a massive relative TAM; and,

is trading at ~6 Price to Sales (P/S), which isn’t bad for a company with 80%+ gross margins, low capital intensity, and 15%+ revenue growth (especially if growth inflects higher).

Portfolio weighting factors: Low to moderate downside / high upside

#6 - HubSpot Inc

HubSpot makes software that helps companies with their marketing → attracting visitors, turning them into leads, and managing sales and customer support in one place (think marketing + CRM + help desk). It’s used to run and manage e-mail campaigns, website forms, customer service tickets, and more.

Their main customers are small to mid-sized businesses (though some larger enterprises use it too).

Marketing is one of the workflows I think could benefit from even the current AI models.

AI can plausibly respond to customer tickets, segment customers, and create bespoke marketing materials for particular customers or target markets.

Hubspot likes to provide the value first and charge for it later. They are providing customers packages of free credits they can spend on current AI features, i.e. resolving customer tickets, and can consider monetization later. I like this strategy as once customers adopt a feature into their workflows, it tends to be sticky. They can always reduce the tokens offered free in the future, or increase prices.

Small businesses don’t have as large of budgets and may be more open to a pay-for-use token model. I think large enterprise clients are more likely to experiment with in-house AI solutions.

Hubspot is trading around ~7 Price to Sales (P/S), which isn’t bad for a company with 84% gross margins, low capital intensity, and 20%+ revenue growth (especially if growth inflects higher).

One of the founders is still at Hubspot as the CTO, Dharmesh Shah.

Risk: their CEO, Yamini Rangan, owns an insignificant amount of shares.

Portfolio weighting factors: Low to moderate downside / high upside

COST EFFICIENCY

These companies can disrupt entire industries by offering better customer experiences at lower costs (through automation with AI). They have

built their tech stack in-house from scratch (the incumbent competition has not), which makes it easier to roll out AI features across the platform.

#7 - Lemonade Inc

(the below is copy/pasted from my last post)

Founder-led: two aligned and highly competent managers

I consider myself a good read of people/management and after watching several of Daniel Schreiber’s interviews, I think he is an Outsider.

Shai Wininger is the tech co-founder who previously founded Fiverr (another $500+ million company) before coming to Lemonade.

Massive market opportunity:

A $6B company disrupting a trillion dollar industry.

Look at the market caps of competitors that are less efficient and have lower NPS scores (Progressive has a $135B market cap).

Structural advantages over incumbents

They target young people (renters and pet owners) which results in lower CAC especially when they cross sell into house and car as the customers age.

They will always have a cost advantage because they cut out brokers (15% cost to some incumbents) and use AI to sell insurance, process claims, and support customers.

Even if incumbents pay someone to implement AI, if there is a recurring cost they will still be at a cost disadvantage.

Insurance is a commodity which means customers are highly price sensitive.

Higher NPS scores than competitors (Trustpilot and anecdotal).

Insurance companies can do better when they’re growing quickly due to float dynamics → you get paid well in advance of having to pay the claims, so if you’re growing you keep collecting more cash in advance of having to pay out claims which provides a safety buffer. As a result, insurance companies in the growth stage have a structural advantage over mature insurance companies.

I guess the risk for Lemonade is they misprice their premiums and face too many losses at once. However, I think even this risk is low as they don’t insure in areas with large catastrophic risks (think hurricane areas), and rents / pet insurance don’t see large spikes and unexpected claims.

Portfolio weighting factors: Low to moderate downside / high upside

#8 - Oscar Health Inc

Oscar Health is a health insurance company that sells medical plans and leans heavily on a digital experience (app, virtual care, care-team support) to make it easier to use your coverage.

They mainly focus on individuals and families buying their own insurance, often through the Affordable Care Act (ACA) Marketplace.

They also offer customizable plans for employers (large white space for them).

Oscar Health is a $4B company disrupting a hundreds of billion $ industry of US Healthcare.

The company has grown revenues quickly from ~$460M in 2020 to ~$11.3B in the trailing twelve months.

High quality management with the founders still involved.

One of the founders is Joshua Kushner, a well-reputed venture capitalist.

The market thinks the biggest risk is the cancellation of ACA subsidies. The Democrats want the subsidies to continue, and the Republicans put forward an idea where citizens would get a stipend to choose where to allocate their healthcare dollars.

I think in both scenarios Oscar is a winner, and perhaps even more so in the latter scenario if Oscar can offer the cheapest and most customizable insurance → it is likely citizens would choose to spend their stipend on the best user experience and value.

You can’t look at individual quarters on their own, Oscar Health earns most of their earnings in the first half of the year and then operates at a loss in the second half (due to the nature of health benefit usage). They will end this year with an overall loss due to an ACA risk adjustment. Oscar has a large cash balance and I don’t think they’ll need funding before reaching consistent profitability.

Compared to competitors, Oscar is highly scalable and their software is built in-house, so I think they should be a beneficiary of AI.

Portfolio weighting factors: Moderate downside / high upside

MODEL COMPANIES

#9 - Microsoft Corp

This is my only investment in the model layer. Microsoft has 27% equity ownership of OpenAI (as of their last filing, their ownership has been diluted since).

Microsoft collects a ~20% royalty on OpenAI’s direct revenue (like ChatGPT and APIs) while retaining the majority of income generated from selling the models to enterprise clients via Azure.

I think ChatGPT is currently being underestimated in the market due to the success of the recent Gemini 3 release.

“ChatGPT” is the verb like “Google,” “AirBNB,” and “Uber”; people use the company names in sentences to describe what they’re doing. The companies that are the verb tend to be the category leaders.

I particularly liked this interview with Mark Chen, Chief Research Officer at OpenAI.

OpenAI has several options to monetize but are instead focusing on taking as much market share as possible (which I think is a good strategy for now). I don’t think they’ll add advertisements to responses until it is clear they have the top model again (sometime in 2026 I’d guess).

Google will be a tough competitor. They have the best model currently, better distribution, and are a highly profitable company which gives them cash to commit to advancing the Gemini product. However, ChatGPT is the current leader in active users, has a more nimble (smaller) team, and has done a better job with product thus far.

I paid for a subscription for both Gemini and ChatGPT for my wife, I told her Gemini was the superior product (and is best at images), but she still uses ChatGPT.

I don’t know who will win the model layer in the end, but ChatGPT is not the only reason I like the investment in Microsoft.

Another anecdote: I got an e-mail from Microsoft informing me that they increased the price of my Office 365 products by 30%. Quite the price increase! I immediately considered alternatives and guess what? I am still using Office 365. They could double the price and I would likely still use Office 365 (don’t get any ideas Satya). Microsoft has incredible pricing power, even if they haven’t exploited it yet.

Yes, I use Google Docs / Sheets too, but I like Office’s desktop versions for particular workflows.

All incremental revenue from these price increases flows to their bottom line, the cost of sending those emails and increasing prices is negligible.

I think we see some of this pricing power flow through Productivity & Business Processes top and bottom line. Github is also under this segment which is seeing nice growth driven by AI coding and Copilot.

Their Intelligent Cloud segment (data centers and cloud services) is going to continue its growth based on everything AI we’ve discussed above.

More Personal Computing includes their Xbox / gaming (Activision) and Windows segments. I’m less certain of the contribution here, but this is still a capital light and highly cash-flowing business.

This interview gets a lot of flak for “popping the AI bubble,” but when I watched it, all I could think of is how well positioned Microsoft is. I think people were too focused on Sam’s responses and overlooked Satya’s comments.

I also like that the sentiment isn’t great for Microsoft compared to the other hyperscalers right now. See this recent poll from Twitter:

A lot of money can be made buying before the crowd agrees with you.

Portfolio weighting factors: Low to moderate downside / moderate upside

SEMI-CONDUCTORS

I typically avoid pure hardware companies (without a recurring software component) completely, especially cyclical ones → it is difficult to project the demand for their products reliably into the future. Even though I think Micron, SK Hynix, and Nvidia could do well, I also think their share prices will drop quickly, and well before I see signs of demand drying up which it eventually will.

#10 - Trio-Tech International

Trio-Tech is an exception to my rule above because I think it is relatively undiscovered (though it has more than doubled in the last 6 months). It is a microcap which means certain investors couldn’t buy it even if they wanted to (until there is more volume).

Trio-Tech provides back-end testing services and equipment that are critical for the complex chips used in AI, including high-memory bandwidth (HBM). They also do work in the automotive sector, particularly with EVs.

We have seen memory demand (and prices) skyrocket in the last few months due to data center demand. Micron even exited their consumer RAM segment to focus on data centers because the demand is so high.

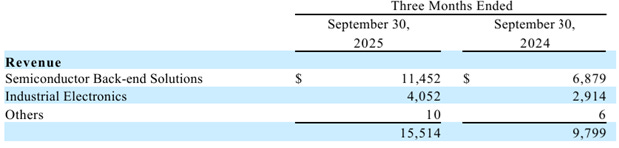

In their last quarter Trio-tech’s revenue took a step change. Their revenues had been flat and decreasing (YoY) for the last 3 years and in the most recent quarter revenues increased 58% YoY.

Their gross profit $ only slightly increased YoY, even in spite of the significant revenue growth, which is curious. Gemini thinks it’s plausible that manufacturers margins take a hit at the beginning of a ramp period, as people and goods are brought in early in anticipation of the demand.

Trio-tech also has high insider ownership.

This is a bet that Trio-tech participates in the AI memory boom.

Insiders sold some of their stock, in December 2025, after the stock doubled in price. The sales were larger than typical for the company. Though, there haven’t been significant sales for a few years and it doesn’t look like the CEO sold any shares. This isn’t always a bad sign, but it’s never a good sign.

Trio-tech is probably the riskiest out of the 10 picks → the recent insider sales + there isn’t a lot of information available on the company, they don’t do quarterly earnings calls and there aren’t many public interviews with management. As such, I have weighted it lower in the Mock Portfolio.

I still think Trio-tech will be susceptible to boom/bust cycles in line with companies like SK Hynix and Micron. Like IREN, this is not a company I would coffee can and check back on in 10 years. I will be watching this one closely.

Portfolio weighting factors: (High downside / high upside)

BONUS: How I use AI in the research process

Here is an example of a conversation I had when researching Cogent Communications in late November (Gemini 3 Pro):

I thought the maps outlining the overbuild were particularly cool (if they’re actually right 😅).

This conversation took between 1 and 2 hours (I was doing my standard research in another tab - financials, insider ownership, etc).

I typically am writing my next question/prompt as the AI is “thinking” → so I can read the last answer while it thinks about the next one.

To get all of that information without AI would have taken a lot longer.

The models are also good at translating different languages and I’ve used it to translate press and financial releases from Japanese companies. Though in hindsight, I feel that part of my edge is in analysing and acting on news quickly → this potential is greatly diminished for non-English reports, so I have found myself hesitant to invest in foreign reported stocks for this reason.

Always review answers with scepticism (especially calculations), double-check what you’re uncertain of, and re-think through the reasoning yourself. I pay for ChatGPT and Gemini, and use both. Sometimes I put the same question into both.

Disclosure: I don’t currently own shares in Cogent Communications.

Disclosure: All amounts and allocations referenced are as of January 2, 2026. As of January 2, 2026 I own shares and/or derivatives in GTLB, IREN, TRT, LMND, DELL, PATH, MSFT, HUBS, TSSI, and OSCR but I may have sold my positions by the time you’re reading this → I trim and sell positions often and I will not necessarily update the blog after I have sold. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — I could be wrong on these ones. Please do your own research and double-check my data & findings.

Please also read my disclaimer and process here: Curious Investing Disclaimer and Process

Very bold and insightful post. My take - electricity is the bottleneck. At Davos, Elon framed electrical power as the limiting factor for AI deployment, even suggesting we may soon be able to build more chips than we can power on.

For investors, this shifts diligence from “AI demand is huge” to “who has credible access to power, interconnect, and delivery timelines, and can monetize that power with AI

The Dell thesis is undersold here imo. The IREN-Dell deal you mentioned is actualy a proof point that Dell's becoming the turn-key integrator for AI infra at scale. Most people still see them as a PC company but that datacenter segment is quietly transforming into a high-margin AI assembly business. The component price passthrough risk is real tho, especially with HBM supply tightness. I've been tracking their guidance revisions and they've consistently beat on datacenter revenue which suggests the pipeline is stronger than street estimates.