Butler National Corporation (BUKS)

Margin of safety; Good capital allocation; Two upcoming catalysts

Butler National Corporation:

Current Price: $0.67 USD

Market Cap: $51.4M

Price Earnings: 6.85 (Real P/E, no significant skewing extraordinary/non-recurring items)

Net Book Value: $44.6M

Quick facts:

Butler National Corporation was established in 1960.

Two primary lines of business which contribute approximately equal amounts of revenue: Aerospace and Professional Services (Casino).

The Aerospace arm primarily performs aircraft modifications.

The Professional Services revenue is primarily driven by the Boot Hill casino in the State of Kansas; they also have some minor architecture work under this segment.

No synergies between the two businesses that I can see.

Both businesses produce strong free cash-flow and are profitable.

The company is currently priced with a fair margin of safety.

Two upcoming drivers of growth/catalysts, one in each business line.

Management:

Management has significant skin in the game and so their incentives are aligned with shareholders. Insiders own 30% of the company and another 19% is owned by two concentrated-long-microcap funds.

In my opinion management has recently made several good capital allocation decisions which I will detail later in the investment case.

Balance Sheet and Financial Health:

Net Book Value makes up almost the entire market cap. BUKS has $44.6M NBV (with less than $1.5M intangibles) on a market cap of $51.4M. The capital assets ($61.6M) include land, buildings, and aircraft - it is possible some of the capital assets are recorded at less than fair market value as there have been minor gains on the sales of a building ($69k gain) and an airplane ($75K gain) in the last 18-months.

They have $41M debt as of the latest quarter, primarily related to a recent 2020 purchase of the casino’s land and building for $42M.

They are paying down debt in recent quarters and plan to continue reducing net debt. It doesn’t appear they will have trouble meeting their current debt commitments based on their latest filings - their free cash-flow and operating profit are well in excess of interest expense.

Let’s dive into the actual business segments and I will start with the Aerospace segment.

Aerospace:

The Aerospace segment develops performance enhancing aircraft modifications, special mission (ISR), and regulatory-driven aircraft solutions. Aerospace customers include operators of single engine airplanes to owners and operators of large commercial and military aircraft. The Aerospace products are sold and serviced globally.

This segment has good operating profit margins, between 15% - 20% in the prior 4 years and aerospace revenue has grown at an 11% CAGR over the last 9 years:

The Aerospace segment has a backlog of work lined up, $22M and growing YoY (as of April 30, 2022). They recently completed construction of a $7M Hangar, in the July 31, 2022 quarter, and as the new hangar becomes operational it should help reduce the backlog and drive short-term revenue growth.

In summary, the Aerospace segment has good operating margins and has consistently grown over the last 10 years. Now let’s move onto the Professional Services segment, focusing on Boot Hill Casino.

Boot Hill Casino:

The casino earns ~25% operating profit, but revenues have been fairly flat outside of their COVID shutdowns which drastically affected revenue for those periods.

Management recently made the two following capital allocation decisions which will increase the bottom line long-term:

Boot Hill purchased the land and building of the casino in 2020 for $42M which will reduce their ongoing lease payments; they took on debt to make the purchase.

Boot Hill had a minority partner in the casino who collected 40% of the earnings from the casino. The minority partner was bought out in 2021 for $16.4M, so now BUKS collects 100% of the income from the casino.

The 40% equity share was purchased for $16.4M on ~$3.4M of earnings (~$8.5M of annual casino operating income * 40% equity purchased) implies ~4.8 P/E or slightly higher after adjusting for taxes.

In my eyes, as far as capital allocation goes, the purchasing of the casino land and building, buying out their minority partner, constructing an additional hangar, and reducing debt are all good examples of management creating long-term value for shareholders.

So the capital structure is improving and they will keep more of the income going forward, is that it? No, part of the asymmetric aspect of this pitch, to me, surrounds online sports betting.

In the US, sports betting had been illegal in most States, but gradually individual States are beginning to legalize sports betting and one of those states is Kansas where Boot Hill resides. Each state decides how sports betting will be administered and in Kansas they chose to have (1) casino operators manage online sports gambling and (2) collect a portion of the earnings from the casino, the % split the State receives is undisclosed.

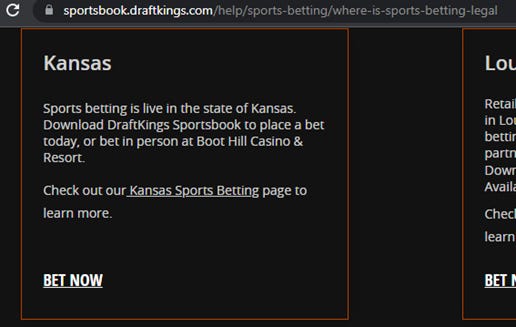

Boot Hill casino has the exclusive agreement with DraftKings (launched Sept 1/22) and Bally (not launched yet) in the state of Kansas. From DraftKings site:

DraftKings provides a turn-key solution (no cost to BUKS) and the online sportsbook went live September 1st. We have the Oct 31/22 results, so how are they doing? The initial results are promising, Boot Hill has recognized $825K sportsbook revenue as of their October 31 quarter-end which includes 2 months of sportsbook revenue (September 1st opening). So the annual revenue run rate would be ~$5M ($825K / 2 months * 12 months). This assumes the first two months ramped up quickly and no growth in the remainder of the year (could be conservative or aggressive, but too early to tell).

It is not clear what the margin of the product is or will be, but this is a turn-key solution provided by DraftKings so the cost should only be what BUKS remits to the State of Kansas (if it isn’t already netted out). Since DraftKings incurs the costs to operate the site, this is a low risk and high ROI initiative for BUKS with the potential for needle-moving returns.

We also know that DraftKings’ revenue increased 81% year-over-year in their latest filing, Dec 31/22. Pretty nice growth there, but that likely includes acquisitions and expansion to new markets like Kansas.

Sportsbook optionality: Boot Hill opened a DraftKings branded in-person sportsbook in March 2023 which could also contribute to revenue growth. Management has further outlined they have the option to open several “marketing locations” i.e. sportsbooks in bars or alternative locations, in the state of Kansas.

Risks:

Gambling rights are temporary and need to be renewed, will the State renew the online sports contract (5-year initial contract for sportsbook)? Gambling rights for the casino were recently renewed until 2039.

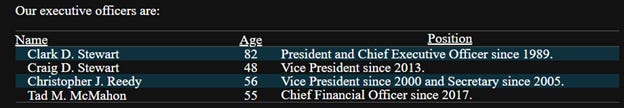

Aging CEO (82 years old), it is possible his son Craig will take over when Clark retires.

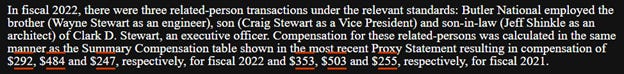

Compensation of non-arms length employees i.e. brother is an engineer, son is a director, and son-in-law is working in the architect division. I don’t see anything untoward with the current compensation.

Other considerations:

As I don’t see many synergies, the company could split out operations into two separate reporting entities. Do the parts trade at higher multiples than the consolidated operations? Probably.

Conclusion:

“Heads I win; tails I don’t lose much.” - Mohnish Pabrai

You don’t need a complex Excel model to determine this company is undervalued. A PE of ~7 is awarded to companies with no growth prospects and companies in bad industries; BUKS has real assets, with significant book value relative to current market cap, and a couple upcoming catalysts. We’ll have to see how it plays out, but these factors provide a margin of safety and limit our downside.

Their next quarter’s earnings should be released in the coming weeks, here are a couple metrics I’ll be looking for:

YoY Quarterly revenue growth in Aerospace AND Professional services business lines.

>$1.0M sportsbook revenue for the quarter.

>$2.5M overall operating profit.

Net debt goes down.

See my next article on BUKS here: Butler National Corporation (BUKS) Q3 Earnings

Disclaimer: As of March 4, 2023, I am a shareholder of Butler National Corporation at an average cost base of $0.67. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings.