Butler National Corporation (BUKS) Q1 Earnings

Not an impressive quarter, but now trading at 5.4 Price to Earnings

Butler National Corporation released their latest quarterly results today:

https://www.sec.gov/Archives/edgar/data/15847/000143774923025831/ex_541364.htm

Overall I think the quarter wasn't great and the market didn’t think so either, dropping the price 11%.

Here is a summary of my thoughts:

Aerospace:

Aerospace revenue increased 28%, but cost of Aerospace products increased 52% (ouch) due to "increases in material and labour costs."

Backlog increased to $29.3M for Aerospace, so there is growing demand here.

Professional Services (Casino):

Overall YoY revenue was flat due to an increase in Sportsbook revenue (nil in the YoY period) offset by a decrease in casino patron spend per visit which BUKS attributes to less discretionary spending.

Casino margin also went down due to increasing labour costs.

We have almost a full year of Sportsbook results now, this quarter was $701K implying a run rate of ~$3.8M per year ([$825K + $1,160K + $753K + $701K] / 11 * 12) which is below my original estimate of $4.8M. It appears September through January earned the highest Sportsbook revenues, likely due to NFL betting. The sample size is still small, but we can temper our Sportsbook expectations for now.

BUKS had negative free cash-flow driven by the payment of severance fees in relation to the Stewarts leaving.

Operating income of $1.1M which we hoped would be higher due to growth in Aerospace and the removal of a portion of the Stewarts' salaries; however, it appears their separation agreements were dated near the end of the quarter so likely not a lot of savings were realized yet.

Repaid debt of $1.3M and repurchased stock of $5.0M (good).

Guiding $7.0M CapEx for FY24 vs $6.5M in FY23.

Update on Valuation

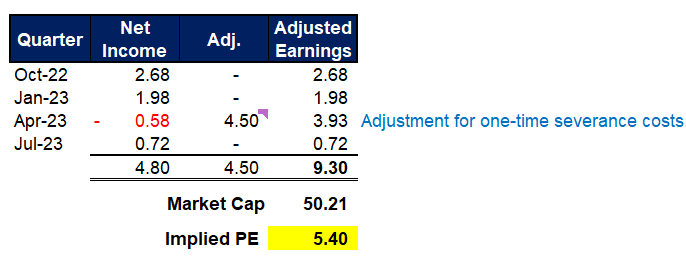

After adding the one-time $4.5M severance costs back to net income, Trailing Twelve Month (TTM) net income would be ~$9.3M implying a Price to Earnings (P/E) of ~5.4 based on today’s price of $0.73. This is before factoring in the removal of Clark and Craig's salaries of ~$1.5M annually; however these savings could be offset somewhat by the increases in labour costs mentioned above.

Summary

I think the company is still cheap today and I have no plans to sell out of my position, especially since the recent org changes will take time to flow through to the company’s margins. Next quarter's earnings, reported in December, will be interesting since it's a tougher comparison ($2.7M net income in the prior year period).

October 14, 2023 update:

Someone named Joseph P Daly is slowly accumulating shares and now owns over 10% of BUKS between himself and his company, EssigPR Inc:

https://www.sec.gov/Archives/edgar/data/15847/000133259623000002/sched13daiix.txt

https://www.sec.gov/Archives/edgar/data/15847/000133259623000004/sched13daix.txt

A quick google search shows that Joe Daly is the founder/CEO of Essig Research which has been in business over 30 years and provides high-tech engineering and manufacturing services. One of their areas of expertise is aviation / aerospace.

This could lend credibility to the quality of Butler National's growing Aerospace business.

Disclaimer: As of September 14, 2023, I am a shareholder of Butler National Corporation at an average cost base of $0.70. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings.

Original investment case on BUKS here: Butler National Corporation (BUKS)

Second article on BUKS here: Butler National Corporation (BUKS) Q3 Earnings

Third article on BUKS here: Butler National Corporation (BUKS) May 12 PR

Fourth article on BUKS here: Butler National Corporation 10-K (Year-ended April 30)