Kits Eyecare FY24 Q1 Earnings

Influencer marketing, guidance, competition, and try-on improvements

Kits Eyecare reported Q1 earnings on Wednesday May 8th. Overall, I think it was a great quarter and, at risk of sounding repetitive, they continue to execute, growing sales and reducing costs as a proportion of revenue.

Here are a couple notes I thought were interesting from the news release and earnings call:

Kits had a customer post a review on TikTok which garnered a lot of attention and co-founder Joseph Thompson mentioned, at the recent Needham conference, that this TikTok post drove significant sales. Since then, Kits has been investing in influencer marketing which I think is a great strategy -> (1) a lot of youth use social media; and (2) since glasses are recurring purchases, the younger you obtain a customer the better.

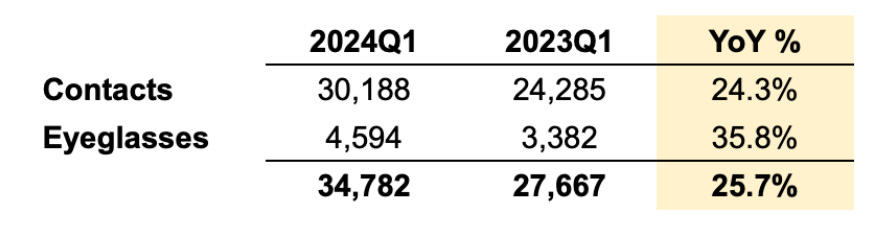

Glasses still make up a small portion of total revenue vs contact lenses, but if eyeglass growth continues to outpace contacts, and eventually becomes a bigger proportion of sales, this could lead to higher overall revenue growth rates. It is also possible that growth could eventually slow for glasses due to the law of large numbers which suggests it is harder to grow as the revenue base gets larger. Regardless, the below growth rates are great for both contacts and eyeglasses.

[Correction July 3/24: this bullet point originally said “35% YoY growth at the midpoint” instead of 25%, but I incorrectly used March instead of June for comparison; all other amounts in the post remain unchanged] Kits gave guidance for the first time this quarter and next quarter (Q2) they're expecting ~25% YoY growth at the midpoint (great - strong revenue growth) and a doubling of their EBITDA % margin quarter-over-quarter to ~4% at the midpoint (great - operating leverage). I'm typically not a fan of guidance because I feel it draws focus from how the company is doing to how the company will do next quarter/year — pulling forward sentiment (good or bad) and satisfying investors with shorter time frames (often analysts). However, one quarter guidance is better than full-year and it's not a big consideration for me generally. I am hopeful Kits will be accurate to conservative in their guidance.

Co-founders Roger and Joseph provided comments on competition during the earnings call. As I have mentioned in previous posts, other companies will have trouble competing with Kits due to their cost structure - Kits provides the highest value proposition through scale economies shared, as the low cost provider.

Roger: "This quarter, we experienced declining competition across many areas of our business, where we saw competitors withdraw from situations where their cost structure simply could not rival our lower cost direct distribution model."

Joseph: "Outside of [Black Friday / Cyber Monday] we've seen less promotional intensity. And that's really been the case in Q1 and it has continued in Q2. For many in the industry as this category moves online at an increasing level, it's a challenge if you have a big network of brick-and-mortar overhead. And it's a challenge if you outsource design and manufacturing or have a big head office. And so for us, our heads are down. We're focused on providing category-leading value and greater selection every quarter and the highest quality with delivering in 1 to 2 days. And as we do, we find it's just -- it's more and more difficult for the legacy industry to compete with that. And that definitely has been what we've seen play out so far in 2024."

Roger: "Our value proposition is cutting through the noise. And so that's why we see -- I think that's why we see a more efficient yield on our marketing spend. I think that others if their offering is weaker [less value offered] will have to spend more. And over time, they'll be inclined to spend less or not really compete with us. And so I think that's kind of what we've seen. We did mention a couple -- to us, it's become clear that there's a few people falling out of the sort of lead and there will probably be others that continue to fall away. Our model really is just getting started."

Kits highlighted the growing use of their try-on software, and subsequently released that virtual shopping in the first quarter surpassed 1 million sessions. They have recently made significant improvements to their try-on software — now you can easily filter try-on glasses only and, more importantly, quickly switch between different glasses. I think this makes the online shopping experience even better as you can virtually try on many different types of glasses more quickly and efficiently than in person.

I’m glad Kits and FITTINGBOX (licensor) are improving this feature as this is what I had highlighted could help accelerate the transition from in-person to online eyeglass shopping in my initial post on Kits in March of last year:

I think the “try-on” feature is one of the bigger value-add experiences as it allows customers to get an in-store experience digitally, and they can see how the glasses look on their face. I haven’t seen any digital eyeglass retailers that have a seamless, and feature rich, “try-on” user interface yet.

It could improve the customer experience if Kits adds a sorting filter to see “try-on” glasses only, then allows you to quickly switch between, and favourite, different eyeglass frames inside the software. This experience would be more convenient than in-store shopping as I don’t know any stores where you can quickly try on 50 pairs of glasses in 15 minutes and easily keep track of your favourites.

News release excerpt below:

Revenue increased by 26% to a record $34.8 million compared to $27.7 million

Gross margin was $11.2 million or 32.1% of revenues, compared to $9.1 million or 33.0% of revenues

Marketing expenses as a percentage of revenue improved by 150 basis points to 13.0% compared to 14.5%

Fulfillment expenses as a percentage of revenue improved by 60 basis points to 11.9% compared to 12.5%

General and administrative expenses as a percentage of revenue improved 10 basis points to 6.9% compared to 7.0%

EBITDA improved by $1.2 million to $1.2 million compared to $(0.05) million

Adjusted EBITDA improved by 100% to $0.6 million compared to $0.3 million

Net income was $0.1 million compared to a net loss of $1.0 million

More than 75,000 pairs of glasses delivered in the quarter compared to 67,000 pairs of glasses

Over 1.35 million glasses were tried on using our Virtual Try-On compared to 0.65 million glasses

Second Quarter 2024 Outlook

For the second quarter of 2024, KITS management expects revenue to be in the range of $36 million to $38 million, with Adjusted EBITDA as a percentage of revenue between 3% and 5%

Disclosure: As of May 25, 2024, I am a shareholder of Kits Eyecare Ltd at an average cost base of $3.34. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings.

Read disclaimer here: Disclaimer & Process