Kits Eyecare Ltd: FY23Q1 Earnings and DCF

EARNINGS: Revenue growth and cost discipline

See my original investment case on KITS here: Kits Eyecare Ltd

Below is a quick update to my original post (Kits Eyecare Ltd), including analysis up to their latest earnings released May 10th.

Current price (KITS.TO): $5.38 CAD

Current market cap (KITS.TO): $168.5M CAD

A couple quotes I liked from the FY23Q1 Earnings call:

“Gross margin increased 250 basis points to 33%”

- Sabrina Liak, Co-founder, President & CFO

“Net Promoter Score was an all-time high … Repeat customers delivered 60% of our revenue in the quarter.”

- Joseph Thompson, Co-founder & COO

“… to see such a high rate of retention in eyeglasses is basically unheard of in the category - to see this many customers return at 18 months, at 24 months.”

- Roger Hardy, Co-founder & CEO

Kits Eyecare is delivering double digit revenue growth with good cost management.

In the table above we see:

Gross margin (Row 20) has increased from mid-twenties to ~33% in the last two years. Kits’ goal is for gross margins to approach 40%.

Contributing factors are lower promotions/discounts and growth in higher margin eyeglasses.

In the future we could potentially see further savings achieved through scale and volume discounts.

Total costs as a % of revenue (Row 44) are steadily decreasing, to ~36%, even taking into account an increase in marketing expense.

Here we see operating leverage, their fixed costs are being offset by growing revenues.

On the FY23Q1 earnings call it was mentioned that Kits has current manufacturing capacity to scale to $200M in revenue and above, in Row 36, we see the capital efficiency of their business model.

Kits is on the cusp of profitability and most importantly, based on their free cash flow, it appears they will not need debt or equity to fund future growth.

As they are in their growth phase it likely isn’t in their best interests to optimize for profitability yet. Instead, Kits has consistently paid down debt (net debt down QoQ and YoY) and has increased their marketing spend which, with their strong retention rates and high net promoter scores, is likely to be a high ROI initiative in the long run.

My anecdotal perspective on valuation:

While it is difficult to value Kits from a margin of safety perspective, I would lump the company in the long-term compounder category, which I don’t see often in micro-caps. A good sanity test for a compounder is that it is plausible that the company could 5x to 10x in the next 10 years (destination analysis). Factors that I think support this plausibility include:

Kits’ large total addressable market in eyecare;

Kits’ strong management team and culture (treats employees well);

Signs of a moat forming (retention rates, and net promoter scores) as a low cost provider;

A long runway for growth, with the company currently valued at $169M CAD; and

Long-term industry tailwinds - eyeglass customers slowly moving from in-store to digital purchasing and increasing screen usage in the population could lead to higher demand for vision correction.

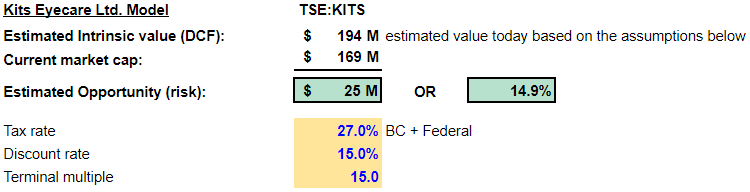

I don't often create DCF models because actual results will rarely fall close to projections and for most profitable businesses investment decisions can be made using simple math. However, since the math is more difficult for companies in the growth stage of the business life-cycle, I prepared the model below to illustrate a scenario in which Kits Eyecare could be undervalued today.

This simple model incorporates estimated maintenance CapEx and one growth CapEx initiative for additional manufacturing capacity once projected revenues exceed $200M in FY27. It ignores potential growth initiatives that Kits may be planning in the future i.e. what will they do with their future cash generated.

Again, these are very rough projections and won’t come close to actual results; this model shows a scenario and assumptions where Kits could be undervalued today. To assess the reasonability of the model yourself, see (1) the assumptions and (2) estimated revenue growth % YoY and other metrics calculated at the bottom of the analysis.

Note: I have updated the model after watching the May 17th Needham Growth Conference presentation - https://wsw.com/webcast/needham131/kits.to/2741300.

Below is the calculation with a discount rate of 15%, which is conservative in my opinion. Warren Buffet has indicated that he uses only the risk free rate, with no equity risk premium, in his discounted cash-flow models. However, he is investing in larger cap companies, so I think the 10% discount rate applied above is fair.

Conclusion:

Kits Eyecare is executing well and has grown revenue QoQ the last 4 quarters while maintaining strong cost discipline. Even if revenue stays flat in the upcoming Q2 quarter they will achieve 27% YoY revenue growth.

The company doesn’t have much institutional discovery yet and has a low float with insiders owning ~80% of the outstanding shares.

With the progress Kits is making, I’m expecting good things in the years to come.

Disclaimer: As of May 13, 2023, I am a shareholder of Kits Eyecare Ltd at an average cost base of $3.17. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings.