Tiny Ltd. Recent Acquisitions

Clean Canvas, Letterboxd and Jagged Pixel (Uptime)

See my first post on Tiny here: Tiny Capital Ltd.

Three Recent Acquisitions (Clean Canvas, Letterboxd, and Jagged Pixel/Uptime)

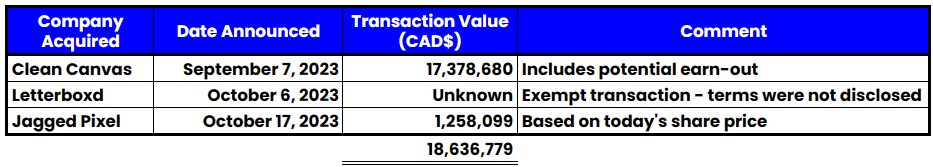

Tiny has been busy since my last post, announcing three new acquisitions. The companies appear small compared to Tiny (currently ~$480M market cap), but they will give us insight into the types of companies Tiny is targeting.

The following analysis will be primarily qualitative since financial statements are not available for any of these acquired companies.

Letterboxd

Here is an excerpt from the press release which explains what Letterboxd does:

Founded in 2011 by film fans Matthew Buchanan and Karl von Randow, Letterboxd has experienced significant growth over the past 5 years, climbing into the top 1,500 websites globally and recently surpassing 10 million members across 200+ countries – a significant milestone from 4.1 million members in 2021 and 1.8 million in 2020. A rare independent social network, Letterboxd has captured the attention of younger audiences, particularly those aged 18 to 24, who are looking for more meaningful ways to connect online around shared interests. Letterboxd’s members gather on the platform to track what they watch, engage in discourse through sharing of reviews and lists, log and rate movies, and follow other like-minded cinephiles.

10 million+ members as of September 29, 2023 from 1.8M in 2020 is an approximate CAGR of 86.76% (Very good).

Letterboxd earns revenue through (1) paid premium memberships and (2) free ad-supported tiers. A quick perusal of their website shows a few standardized Google ads and, although I have no advertising expertise, I feel there is an opportunity for Tiny to improve their advertising model.

The business appears to have several strong characteristics:

As a social media site its users spend more time on the site (more ad impressions) and they create free content for the company. Social media sites are also notorious for their network effects which can produce a strong and sustainable competitive advantage:

A network effect refers to the concept that the value of a product or service increases when the number of people who use that product or service increases i.e. the value of these websites increase as more people sign up for accounts on the site - as more users sign-up with the website, more content is created, increasing the user experience and driving more users to the site.

It is also a filter business which I’ve described briefly in my Trustpilot investment case:

In the online age with consumers having an abundance of options, from entertainment to online storefronts, filters are increasingly important and they will continue to gain importance over time.

The financial characteristics of this business imply that it should trade at a high multiple (of revenue/earnings/etc.):

High growth;

Advertising and membership revenues are typically high margin; and,

Low capital intensity, which means they don’t need to spend a lot on Capital to earn revenues.

Highly leverageable and scalable (similar to the next two businesses we will discuss).

Because their products and services are digital they can be replicated and delivered to a large number of users with minimal incremental investment. This can be achieved because most of the costs are fixed or incurred upfront in the development & infrastructure and the variable costs associated with producing each additional unit or serving each additional customer are minimal. As a result, they can serve a growing customer base without proportionally increasing costs.

Two large well-known competitors are Rotten Tomatoes and IMDb, but Letterboxd’s recent growth indicates they may have carved out a niche for themselves.

Another interesting item to note is their recent partnerships:

Netflix (~$180B market cap); link: Netflix Letterboxd HQ Announced: How to Log Watchlists - Netflix Tudum

Oscars; link: (ACADEMY PARTNERS WITH LETTERBOXD TO CREATE EXCLUSIVE 95TH OSCARS® CONTENT | Academy Press Office)

These are large and credible companies.

We cannot do a fulsome analysis or valuation with the information provided in these press releases and without any financial statements, but this seems like a great business qualitatively.

Clean Canvas & Jagged Pixel/Uptime

Clean Canvas (Themes) and Jagged Pixel/Uptime (App) both sell products through the Shopify ecosystem. In order to assess the tailwinds of Shopify’s ecosystem (TAM), we can review Shopify’s quarterly results. Shopify is currently exhibiting strong growth, even in what some would consider a tough economy with consumer disposable income being pressured.

From the Clean Canvas press release:

Clean Canvas is a leading designer and developer of premium themes which have been leveraged by over 80k Shopify merchants, and will continue to operate as an independent brand following closing.

From the Jagged pixel press release:

Jagged Pixel operates Uptime, the leading automated store monitoring application on Shopify. Through 24/7 monitoring, Uptime allows merchants to detect and resolve issues on their Shopify stores within seconds.

Both of these businesses exhibit the same advantaged financial characteristics we discussed with Letterboxd - high margins, low CapEx, scalability, and leverage.

Most of the CapEx-like cost of a theme or app is incurred in development and because their products and services are digital they can be replicated and delivered to a large number of users for low cost. Shopify charges 15% after the first $1M USD / year, so the gross margins for these products would be around 85% (very good).

The multiple given to these businesses should be high due to the aforementioned high margins, low capital intensity, and likelihood of growth with Tiny’s marketing and Shopify’s continued success.

All of Clean Canvas' themes reviews that I checked were above 88% positive, and mostly > 95%.

Uptime launched May 16, 2022 and has all 5-star reviews (28 of them) on the Shopify app-store. Here are a couple of the reviews:

Assuming these are legitimate reviews, the app appears to add value and customers can recognize it.

General Thoughts

(1) These digital/internet companies seem better than traditional companies when I compare the types of companies Tiny is acquiring vs other serial acquirers. I like the advantages of scalable/leverageable business models, low capital intensity, and high margins.

Although we haven’t seen these advantaged qualities shine through in the financials yet, I am hoping Tiny determines some metrics to share with the public that help provide transparency into how segments are doing i.e. organic growth vs acquired growth (Mark Leonard at Constellation Software put a lot of thought into this). It would also be nice to see some metrics we could use to assign an approximate value for all companies acquired; however, it could be argued that this would give away too much to competitors.

(2) How could these be good deals if there is a lot of competition for these types of companies? Per Tiny, they are similar to Berkshire and owners like to work with them because of their experience, temperament, access to capital, and reputation. They provide quick 30-day deals and leave the business alone for the founder to manage, resulting in Tiny being the long-term buyer of choice in their niche. This is plausible, but hard to determine if they are getting good deals without more info (purchase price / sales, etc.).

(3) They are buying some companies with their own shares and some may argue if they are allocating capital correctly this indicates that they think their stock is overvalued. However, with the sellers being encouraged to continue running the company, stock may be preferred and this leaves Tiny with more cash to make additional acquisitions. Further, these particular share issuances are a tiny portion of their market capitalization.

Summary

I mentioned in my previous post I thought there may be better opportunities at the moment, however the stock price has dropped over 30% since then and I have started my initial position with the plan to dollar cost average over time.

I’m not sure if we have seen the bottom in stock price since revenue growth & profitability have been sporadic which investors don’t like to see, but I believe in their team, culture, and strategy and I really like the types of companies they are targeting. If they really are the Berkshire Hathaway of the internet, this will be a long journey and you will have many opportunities to purchase along the way and still perform exceptionally.

Bonus Recommendation: Interview with Charlie Munger

- Sponsored by Tiny

Charlie Munger is an American investor, business partner of Warren Buffett, and the vice chairman of Berkshire Hathaway. He is known for his financial wisdom and is considered one of the most knowledgeable thinkers in the world.

He wrote the book Poor Charlie’s Almanac which I recommend as a great read. You rarely see him do interviews outside of Daily Journal annual meetings and I think this recent one is a good listen: Acquired Podcast - Charlie Munger

See the following link for my next post on Tiny: https://curiousinvesting.substack.com/p/tiny-capital-update

All of my posts on Tiny can be found here: https://curiousinvesting.substack.com/t/tiny-capital-ltd

Disclaimer: As of October 31, 2023, I am a shareholder of Tiny Ltd. at an average cost base of $2.61, I purchased an initial ~2% allocation yesterday. My plan at the time of writing is to hold these shares long-term, but I may have sold my position by the time you’re reading this. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — this could be one I’m wrong on. Please do your own research and double-check my data & findings.

Thanks again @TheCuriousInvestor, insightful qualitative analysis. The piece on using their shares instead of using cash is interesting and does make me wonder on whether their shares are overvalued.

There's indication from latest MD&A that we’ll see the full impact of cost-cutting & revenue accretion from recent acquisitions in Q4 / Q1, I am curious to whether they will separate the performance for transparency.