Three Years In: My Report Card

My performance, latest thoughts on each company, and a new pick

While I much prefer a five-year test, I feel three years is an absolute minimum for judging performance. It is a certainty that we will have years when the partnership performance is poorer, perhaps substantially so, than the Dow. If any three-year or longer period produces poor results, we all should start looking around for other places to have our money.

— Warren Buffett

It has been nearly three years since I started this blog, so now might be a good time to take stock of how I’ve performed.

In this post I will:

provide an update on how each pick has done (good and bad),

share what I think about each company today, and

as a bonus, share one new pick I recently purchased.

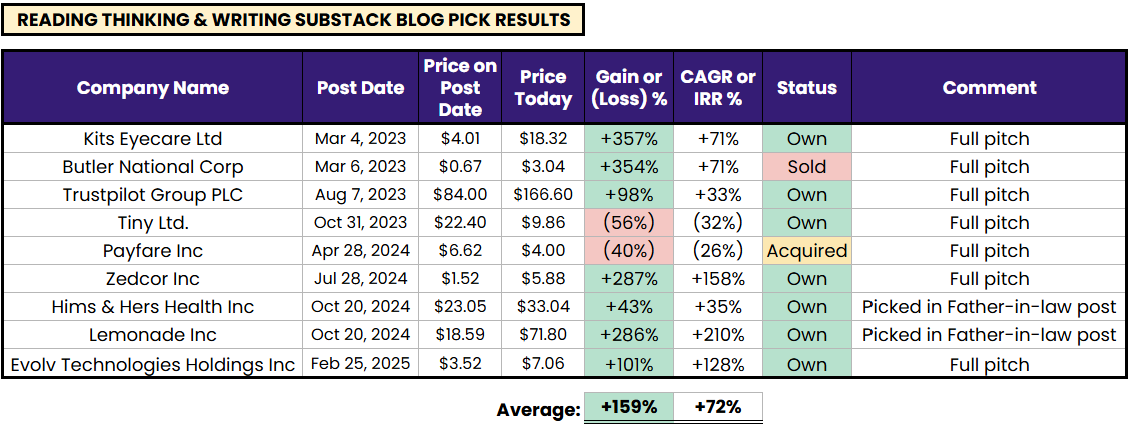

Here is a summary table of returns since the companies were published on my blog (links to the actual posts are provided below):

I still own 7 out of the 9 holdings, though I have trimmed some and added to others. If I still own them today I am still optimistic about their future prospects.

The average return is 159%, which I’m quite happy with especially as some of them were published more recently (all less than 3 years ago).

7 of 9 (78%) with positive returns is above my target aiming to be right 60% of the time.

My personal portfolio has performed slightly better than this over the last three years: I have surpassed +100% return in both 2024 and 2025 (more than doubling my portfolio two years in a row), after earning ~25% in 2023.

My personal results did not come from heavy concentration or excessive risk (in my judgment). Since 2023, I have:

held between 20 and 30 positions;

used less than ~5% leverage on average; and

purchased small LEAPS positions (1-2% by cost) and QQQ Puts (market hedges).

Below I will go into my current thoughts on every company I’ve published on my blog. I also share the allocations for select holdings, but consider that I can trim and/or sell positions at any time and I may not own the company by the time you’re reading this.

Kits Eyecare Ltd (full pitch link) - Still Own

+357% since March 4, 2023 (+71% CAGR)

My thesis for Kits Eyecare hasn’t changed much since my original posts.

The management team is aligned and executing well (founder-led).

In my view, the two large tailwinds for Kits are far from over:

more people will need vision correction as heavy screen usage continues, and

the transition from in-store to online eyewear purchases, especially as virtual try-on technology improves.

They still have a mostly capital light business model with predictable revenues.

Competition is the biggest risk here.

Kits recently announced a new store opening in Toronto, which is interesting because part of their competitive advantage is that they don't have a lot of retail shops (lower overhead/costs).

Here is why I think this could be a good thing:

This is the first storefront they are opening in the last few years, so it appears they are taking a measured approach and not a blitz of store openings to increase revenues at worse margins.

I like that it’s in an entirely new city. If they start opening multiple stores per city, I might have to re-assess (see Warby Parker).

I am happy using the online ‘try-on’ feature, but I know it is a non-starter for some. Having a store for people to go in and try glasses, and get a prescription, opens Kits up to additional customers. I do think the try-on feature will get better with AI (buzzword, but could actually make trying on different glasses virtually more seamless). I think it will take years, not months though.

I am glad to hear they are including a coffee shop in this one as well. My wife and I stopped by their Kitsilano store and really enjoyed the vibe, though it was a bit tight in there (due to its small size and a lot of customers). We tried on a lot of pairs, wrote down the glasses we liked, and then purchased online later.

We don’t have as much tailwind from a multiple re-rating as we did before, but I think we could see Kits at a $1B market cap eventually, it’s just a matter of when.

Butler National Corp (full pitch link) - Sold

+354% since March 6, 2023 (+71% CAGR)

I wrote my reasons for selling here:

My reasons for selling were:

Due to the capital intensive nature of the business;

The fact that a large portion of the enterprise value is tied up in a casino with low growth (albeit with high cash-flow);

Opportunity cost.

The stock has continued to perform since I sold, and I continue to think the Aerospace division is a gem.

One of the difficulties in running a portfolio of less than 30 companies is that even if you still like a company, you may confront selling it when you find opportunities you perceive as better (opportunity cost).

Trustpilot Group PLC (full pitch link) - Still Own

+98% since August 7, 2023 (+33% CAGR)

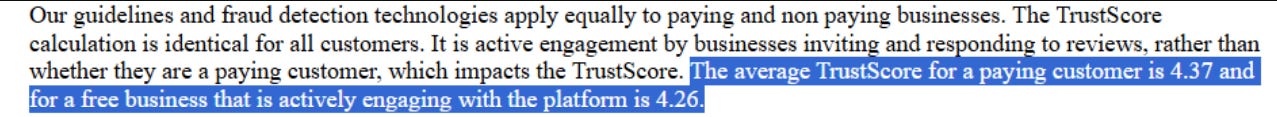

There was a recent short report by Grizzly Research which had a fairly narrow scope: they questioned the legitimacy of a selected sample of reviews/ratings and posited that Trustpilot manipulates or selectively enforces its policies depending on whether the company is a paid customer or not.

Here is Trustpilot’s response: https://www.londonstockexchange.com/news-article/TRST/trustpilot-rejects-categorically-false-allegations/17361644

Some excerpts I thought were relevant:

and

My thoughts:

I don’t doubt there are fake/paid for reviews on the site, it would be too difficult to eliminate all fakes, especially in the age of AI.

Assuming the above stats from Trustpilot are true, then it is plausible the short report only selected samples which confirmed their narrative.

I can’t know if they are unbiased in their enforcement. Similar claims were made against Yelp in the past, but my gut tells me Trustpilot puts more effort into being a good faith platform than Yelp had historically. Yelp is still around, though their earnings multiple (price and enterprise value) has underperformed since IPO (I think Trustpilot is a better business regardless).

Trustpilot does admit that paid customers get access to send automated review links to customers, but they also state the company has to send the review links to all customers, not selectively (not sure how this is enforced but they do mention going after customers for this). For good companies this process could help increase their rating because I think, all else equal → customers are most likely to go on Trustpilot to leave a review if they have a negative experience, however, if every customer receives a prompt/email to review a company after purchase you will likely get more positive reviews.

Several board members & insiders, including the CEO and CFO, purchased more shares after the short report (approx. $510K USD total). Specifically telling is the shares purchased by Hanno Damm, the CFO, as he is stepping down in 2026.

The company has also ramped up share repurchases and have repurchased over 4% of diluted shares outstanding since June 30, 2025.

My two biggest worries with the company are:

If SBC continues to increase; and/or

OpEx only comes down slowly/slightly as a % of revenue over the coming years.

Both of these are agency issues, a result of low management share ownership → if management doesn’t own a lot of shares they may be less concerned with realizing shareholder value. One mitigating factor is that part of their compensation is based on share price performance.

Management/insider ownership will be even lower once Hanno steps down from the CFO role.

Trustpilot has a nice business model with obvious network effects. My hope is they continue to compound at ~15%+ revenue growth (if they can get above 20% even better) and bring down their costs as a % of revenue at a meaningful pace. If this happens, on a long enough time horizon your IRR% on the investment should earn whatever their revenue growth is combined with any re-rate in their market multiple (good or bad).

Tiny Ltd (full pitch link) - Still Own

-56% since October 31, 2023 (-32% CAGR)

Tiny is the most controversial company I’ve pitched (likely because Andrew, the founder and largest shareholder, is polarizing), but also because their financials are confusing.

The long-term thesis is fairly straightforward, you need to believe that (1) Andrew and Chris get access to good companies that others don’t; and (2) that they are skilled enough to discern which companies are good buys at a particular price.

I believe both of those things.

Andrew started as a freelancer in a coffee shop 20 years ago and created a $275M company (with ~$30M in free cash-flow). If you looked at a historical chart for the 15 years before they came public, their earnings likely went up in a steep curve. Do you think they’ve now hit their limit? I don’t.

A complaint I see is that revenue growth has plateaued and is falling in some quarters. The reasons revenue hasn’t grown is partly due to:

Cyclicality of Metalab design agency (Digital Services Segment). Agencies are notoriously project-based and cyclical (boom/bust). This sort of work has become less of a focus for Tiny and their focus has shifted to predictable, recurring revenue business.

Sales of portfolio companies (WFH job board and design agencies), and

The Tiny Fund → From 2020 onwards, Tiny invested ~$40M CAD in a GP/LP structure where revenues of the underlying businesses are not consolidated on their financial statements (i.e. “hidden” from reported revenue). Had this cash gone to traditional acquisitions it would have bolstered revenue.

I think revenue could start to grow again as new cash flow (less debt repayments) is deployed into traditional acquisitions instead of the fund structures. And if revenue growth does return (resulting from short payback acquisitions) I think the stock price will follow.

The company is also available at a reasonably cheap valuation:

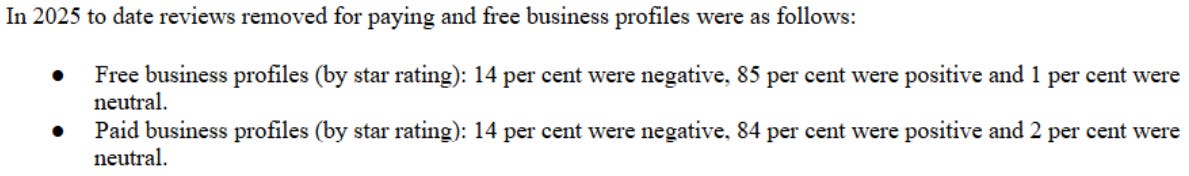

Tiny has complicated financial statements with a lot of adjustments, but I believe the most fair assessment of their underlying profitability is Adjusted EBITDA, less SBC. This metric excludes one-time costs or income i.e. severance expenses and gains on sale of subsidiaries, but deducts real costs like stock based compensation (SBC).

Enterprise Value is ~$465M

$38.2M Adj. EBITDA TTM, less $2.8M SBC = $35.4M

~ 13 EV to EBITDA ($465M / $35.4M)

Note: the Enterprise Value and EBITDA both include non-controlling interests (Serato & Dribbble), which can be difficult to normalize (as they break out their financials); however, I think attributing ~$75M in EV to non-controlling interests is a fair adjustment.

A large portion of EBITDA adjustments are related to Depreciation and Amortization (D&A), but when you read the notes to the financial statements you realize that D&A is mostly made up of adjustments to intangible and non-recurring investment.

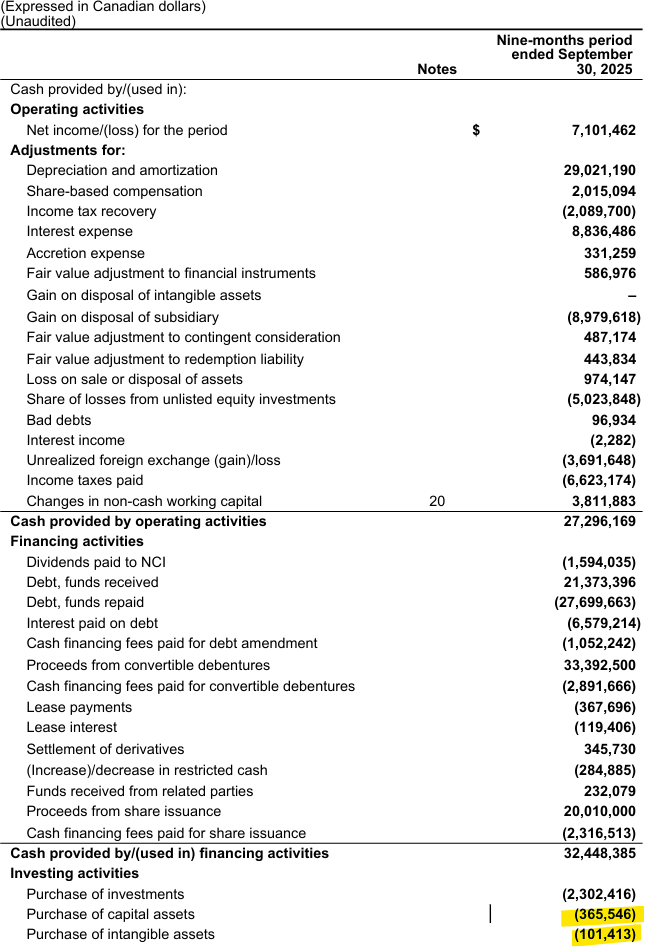

The easiest way to see this is to look at their cash-flow statement, here is an excerpt of their cash-flow statement for 2025 YTD:

… and here is full year 2024 and 2023:

Under $1M in capitalized expenses each year (on $50M of revenue), but they are showing > $35M in annual depreciation and amortization expense? You should realize based on this that net income could be understated by up to $34M (and we can see income is understated by looking at the free cash-flow) → this is why some investors get the business wrong, they think the company is unprofitable looking at standard metrics that don’t show the whole story.

Adjusted EBITDA is “bull**** earnings” for companies with maintenance CapEx, but it actually does a decent job approximating earnings for capital light companies. Sometimes you just have to add your own adjustments on top.

I also think it is quite impressive Tiny has acquired so many companies in the last 20 years and none of them need much maintenance capital at all.

Payfare Inc (full pitch link) - Acquired

-40% from April 28, 2024 to acquisition on March 3, 2025

Here is what I wrote in my original pitch:

Summary

Payfare Inc is profitable with expanding margins, strong revenue growth, low capital intensity, and low customer acquisition costs — all at what I think is a fair price — there is a lot to like here. There is also some hair, like with a lot of small caps, and I can justify the risks all I want but there is real downside here.

Those risks came to fruition shortly after I posted.

Payfare’s stock increased to over $8, dropped to near $2 (!!) after the news they lost their biggest customer, and then the company was acquired at $4 a few months later.

What a rollercoaster.

I cannot say buying Payfare was a bad decision just because of the bad result. If we ran the decision in 100 different universes, how would the investment play out on average (maybe the investment would end up profitable on average)? Though, in the future I will likely allocate a smaller initial position to a company with real downside risks like this.

I ended up holding my shares and buying more when the stock dropped near $2 which reduced my overall loss when the company was acquired at $4. I still lost money overall when all was said and done. In hindsight, I think buying more at $2 was a mistake even though the result was good (reducing my loss).

Payfare had the best financial metrics I’d seen for the price (revenue growth, profitability, scalability/low CAC) up to that point, and perhaps since.

One company which I think is close (great quality for the price) is Duolingo. I initiated a position in Duolingo earlier this month at $192.

Duolingo, like Payfare, has real risks, but instead of customer concentration risk, they have AI disruption and fad risk. What I like: trading cheap on profitability & growth + capital light + founder led + predictable revenue + float-like working capital dynamics + category leader + scalability + sentiment is bad and is detached from fundamentals.

If these risks don’t materialize, I think Duolingo could be a multi-bagger.

I’ve sized the Duolingo position at 2% currently, perhaps learning from my Payfare experience to attribute lower weighting to investments with higher perceived downside risks (the principle the Kelly Criterion is based on).

Zedcor Inc (full pitch link) - Still Own

+287% since July 28, 2024 (+158% CAGR)

I still own Zedcor though I’ve trimmed the position quite a lot. Zedcor has been over a 10-bagger vs the price I originally purchased most of my shares at.

The management team is executing well and I still think the company has significant tailwinds at its back:

More money will be spent on security as people feel increasingly unsafe → a) faster and better distribution of news makes crime feel more common, even if it isn’t, and b) expanding income inequality could increase crime rates;

Transition of in-person security guards to remote monitoring (the towers are cheaper, safer & more effective).

The valuation is arguably high, but the company is also growing incredibly fast (80% TTM).

I do wonder what the market will do (to the price in the short-term) if their tower utilization drops below 90% over a few quarters.

My gut tells me Zedcor could compound for years to come.

Hims & Hers Health Inc (Father-in-law post) - Still Own

+43% since October 20, 2024 (+35% CAGR)

I bought a lot of my shares under $10 and I still own shares; HIMS is currently around a 5% position in my portfolio. The stock trades up and down erratically based on news and sentiment, however the underlying business doesn’t change nearly as much. The company has:

Aligned and highly competent management (founder led)

Massive market opportunity

I think home testing will do well and lead to significant cross-sell (optionality).

Peptides are a lottery ticket.

Structural advantages over incumbents through tech-enabled platform

There are real risks here, especially with regards to competition (could squeeze margins) and regulation. They are selling essentially the same products as their competition, so they have to differentiate on customer experience (technology/convenience), cost (scale), and marketing.

Here is one thing I think the bears are missing → If the business succeeds in disrupting consumer healthcare, the market opportunity is so large that you are plausibly looking at a 10 or 100 bagger.

“Whoa whoa!”, the bears would say, “the company will likely fail due to competition, shrinking margins, and regulatory pressures.”

Ok, well let’s do some paper-napkin math:

Credit: Gemini 3 Pro

(The above is meant to be illustrative and the actual distribution of outcomes for Hims and Hers would be less extreme).

Even if we allocate the chance of ‘total failure’ to 50% (or 90%), you can make a scenario where this would be a good “bet” mathematically.

This is akin to venture capital (VC) investing, where returns are driven by a few outsized tail outcomes.

You wouldn’t want to include a bunch of companies in your portfolio where 90% of the time you had a bad result (investment stays flat or you lose your investment). Though, I think Hims and Hers’ potential outcomes are much more favourable than above → in my opinion they have much lower risk of both total failure and staying flat.

This is just an exaggerated example of how you might justify adding a company with real downside risk to your portfolio. The reality is you can only lose 100% of your investment when you purchase shares, but you could double, triple, or 10X an investment.

Regardless, if there is a real downside risk, you won’t want a lot of these investments in your portfolio and I wouldn’t allocate a lot to the investment. This is similar to what I mentioned about Payfare above; and I touched on in my post on Portfolio Construction.

Lemonade Inc (Father-in-law post) - Still Own

+286% since October 20, 2024 (+210% CAGR)

I bought most of my shares under $20 and still own shares. Lemonade is one of my top holdings at ~15% weighting.

Founder-led: two aligned and highly competent managers

After watching several of Daniel Schreiber’s interviews, I think he is an Outsider CEO.

Shai Wininger is the tech co-founder who previously founded Fiverr (another $500+ million company) before coming to Lemonade.

Massive market opportunity:

A $6B company disrupting a trillion dollar industry.

Look at the market caps of competitors that are less efficient and have lower NPS scores (Progressive has a $135B market cap).

Structural advantages over incumbents

They target young people (renters and pet owners) which results in lower CAC especially when they cross sell into house and car as the customers age.

They will always have a cost advantage because they cut out brokers (15% cost to some incumbents) and use AI to sell insurance, process claims, and support customers.

Even if incumbents pay someone to implement AI, if there is a recurring cost they will still be at a cost disadvantage.

Insurance is a commodity which means customers are highly price sensitive.

Higher NPS scores than competitors (Trustpilot and anecdotal).

Insurance companies can do better when they’re growing quickly due to float dynamics → you get paid well in advance of having to pay the claims, so if you’re growing you keep collecting more cash in advance of having to pay out claims which provides a safety buffer. As a result, insurance companies in the growth stage have a structural advantage over mature insurance companies.

I guess the risk for Lemonade is they misprice their premiums and face too many losses at once. However, I think even this risk is overstated as they don’t insure in areas with large catastrophic risks (think hurricane areas), and rents / pet insurance don’t see large spikes and unexpected claims.

Evolv Technologies Holdings Inc (full pitch link) - Still Own

+101% since Feb 25, 2025

This is another one of my top holdings at ~10% weighting.

Evolv benefits from some of the same security industry tail-winds as Zedcor, but I like that their product is more proprietary (less competitors with the exact same product).

I still think they have a lot of market room to grow organically → penetration of schools, hospitals, and new potential markets (events, workplaces, etc) is still low.

The two downsides I see for the company are (1) that valuation isn’t cheap (but my gut tells me this company will rarely look cheap); and (2) that management is new / unproven and the new CEO doesn’t own significant shares. Though I have only seen good signs since he started + there was some insider buying recently.

On the valuation point I look at it like this → I struggle to see a scenario where this company isn’t a lot bigger in 5 to 10 years, the market opportunity is too big vs their current ~$1.2B (at the time of writing) market cap.

If you made it this far, thank you!

In my next post, which I plan to publish soon, I will include additional names I own and am bullish on going into 2026, under a common theme.

Disclosure: All amounts and allocations referenced are as of December 30th, 2025. As of December 30th, 2025 I own shares and/or derivatives in KITS, TRST, TINY, ZDC, HIMS, LMND, EVLV, and DUOL but I may have sold my positions by the time you’re reading this → I trim and sell positions often and I will not necessarily update the blog after I have sold. This is not a purchase recommendation and I can only hope that I’m right on 3 out of 5 (60%) investments I make — I could be wrong on these ones. Please do your own research and double-check my data & findings.

Please also read my disclaimer and process here: Curious Investing Disclaimer and Process

Great review

Great to have you posting again! Happy New Year